AI in Wealth Management: How AI is Transforming Client Experience and Investment Strategies

Table of Contents

Have you noticed how financial services are changing faster than ever? If you work in wealth management or even follow the industry, you have probably seen artificial intelligence becoming a game-changer.

Today, AI in wealth management is not just a buzzword—it is a powerful tool firms are adopting at record speed. Why? Because the demands of clients are evolving, and traditional approaches are no longer enough. Clients want faster insights, personalized strategies, and smoother experiences. At the same time, firms need smarter ways to analyze markets and boost portfolio performance.

This article will guide you through how AI is reshaping wealth management. You will discover how it enhances client experience, improves investment outcomes, and creates a competitive edge for forward-thinking firms. If you are curious about how technology can help you make better financial decisions or manage clients more effectively, then keep reading—this breakdown is for you.

Table of Contents

What is AI in Wealth Management?

If you have ever wondered what “AI in wealth management” really means, think of it as bringing intelligence into financial decision-making. Artificial intelligence in wealth management refers to using machine learning, natural language processing, and automation tools to make smarter, faster, and more personalized financial strategies.

Instead of relying only on manual analysis, advisors and firms now use AI to uncover patterns in massive amounts of financial data. This means clients can receive better advice, firms can operate more efficiently, and portfolios can be managed with greater precision.

Here is how AI integrates into wealth management today:

1. Portfolio Management

AI algorithms can scan global market data in seconds. They identify trends, evaluate risks, and recommend the best asset allocation for individual investors. For example, robo-advisors like Betterment or Wealthfront use AI to automatically rebalance portfolios based on market changes and investor goals.

2. Client Advisory

AI helps financial advisors provide hyper-personalized recommendations. Instead of generic strategies, clients get advice tailored to their income, spending habits, and long-term goals. Imagine logging into your financial dashboard and seeing suggestions that feel written just for you—that is AI at work.

3. Risk Assessment

Traditional risk assessment often relies on static questionnaires. AI, however, constantly analyzes client behavior, market conditions, and global events to reassess risk levels in real time. For instance, if a market downturn is coming, AI systems can flag it early and recommend adjustments to protect investments.

4. Automation of Tasks

Wealth managers spend hours on repetitive tasks like generating reports or handling compliance paperwork. AI-powered automation takes care of these processes, freeing up advisors to spend more time with clients. This not only boosts efficiency but also improves client relationships.

In short, AI in wealth management means blending human expertise with intelligent technology. Advisors gain sharper insights, clients enjoy more personalized experiences, and firms can achieve stronger performance with less effort.

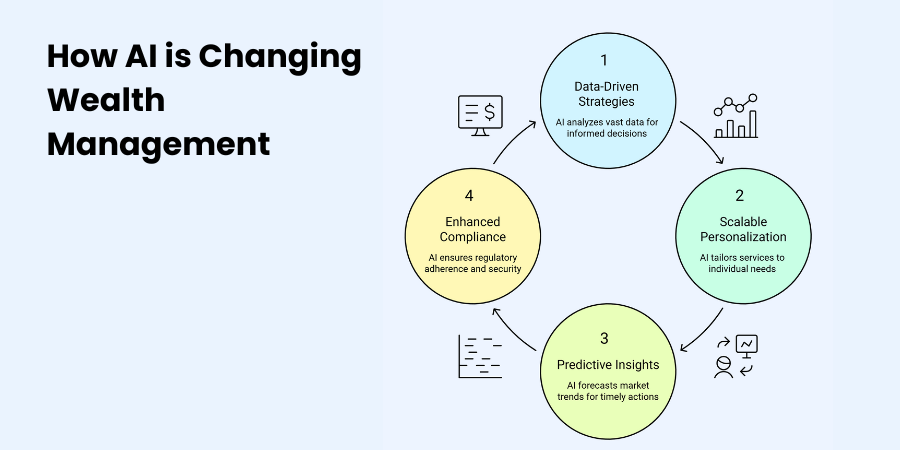

How AI is Changing Wealth Management

Wealth management is no longer what it used to be. The traditional model—where advisors relied on manual research, intuition, and time-consuming processes—is being replaced by data-driven strategies powered by artificial intelligence. If you have noticed advisors talking more about algorithms than spreadsheets, this is exactly why.

Here is how AI is driving this transformation:

1. From Manual Advisory to Data-Driven Strategies

In the past, portfolio decisions often depended on human judgment and limited data sets. Today, AI analyzes enormous amounts of financial information instantly—market trends, client behavior, even global news events. This shift allows wealth managers to design smarter strategies that are backed by data, not just instinct.

Example: Investment firms like BlackRock use AI-driven platforms to process market signals and adjust portfolios with far greater accuracy than manual methods.

2. Scalable Personalized Services

Clients no longer want “one-size-fits-all” advice. They expect financial strategies tailored to their specific goals, lifestyles, and risk tolerance. AI makes this possible on a larger scale. Algorithms can segment clients, track financial behavior, and deliver personalized recommendations to thousands of investors simultaneously.

Example: Robo-advisors offer customized portfolios for millions of users at once, something human advisors alone could never manage efficiently.

3. Improved Predictive Market Insights

Timing is everything in investments. AI helps predict market movements by identifying patterns in real-time data. These predictive insights help advisors and firms anticipate risks and opportunities before they fully unfold.

Example: AI systems can detect early signals of economic downturns, enabling firms to shift strategies and protect client portfolios in advance.

4. Enhanced Compliance Monitoring

Regulations in finance are complex and constantly changing. Manual compliance checks can be slow and prone to errors. AI simplifies compliance by automatically scanning transactions, monitoring activities, and flagging unusual patterns that may indicate risks.

Example: Many global banks now use AI-powered compliance tools to detect fraud, prevent money laundering, and ensure transparency in financial operations.

Together, these changes show that AI is not just improving wealth management—it is reshaping it completely. Clients get more value, firms operate more efficiently, and the industry as a whole becomes more future-ready.

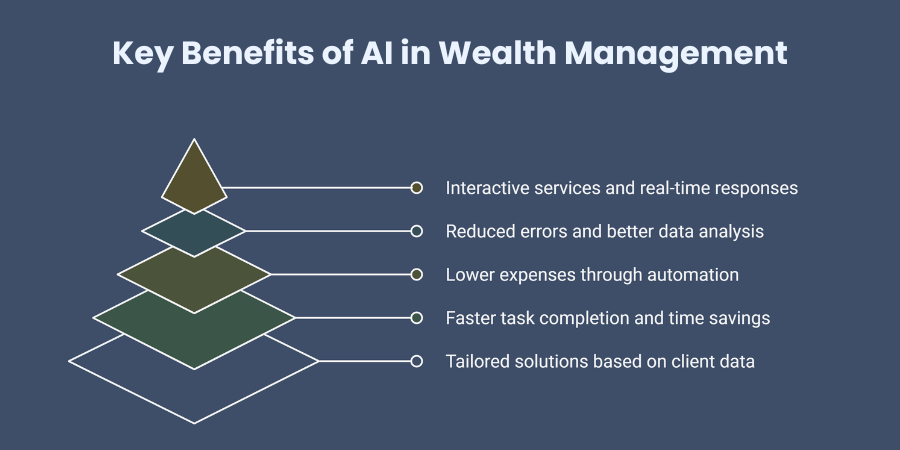

Key Benefits of AI in Wealth Management

If you are still wondering why so many firms are turning to artificial intelligence, the answer lies in the benefits it delivers. AI is not just another tech trend; it is a tool that directly improves how wealth managers operate and how clients experience financial services.

One of the most significant benefits is the ability to create personalized investment strategies. Instead of offering general advice, AI analyzes each client’s goals, spending habits, and risk profile to design tailored solutions. This makes clients feel understood and supported, which strengthens trust and loyalty.

Efficiency is another area where AI makes a huge impact. Tasks that once took hours—such as preparing reports, analyzing portfolios, or reviewing compliance documents—can now be done within minutes. For wealth managers, this means less time lost on repetitive work and more time available for building meaningful client relationships.

The adoption of AI also helps reduce operational costs. Firms that use automation spend fewer resources on manual processes and avoid costly errors. Over time, this translates into higher profitability without sacrificing service quality.

Accuracy is equally important in financial decision-making, and AI excels here. By processing massive volumes of data instantly, AI reduces the chance of human error and identifies patterns that may not be obvious to traditional analysis. This leads to smarter, more reliable strategies for both advisors and clients.

Finally, client engagement reaches a new level with AI integration. From personalized dashboards to instant responses via chatbots, clients enjoy more interactive and responsive services. They no longer need to wait days for answers—AI tools keep them connected and informed in real time.

Real-World Use Cases & Examples of AI in Wealth Management

1. AI-Powered Robo-Advisors

Overview: Robo-advisors use AI algorithms to provide automated financial planning and investment services with minimal human intervention.

Industries Served: Financial services, retail banking, and personal investment management.

How It Works: They analyze client goals, risk appetite, and financial history to design customized investment portfolios. AI continuously rebalances portfolios based on market changes.

Impact: Wealth management firms save time and deliver low-cost, scalable investment solutions, making financial planning accessible to more clients.

Real-World Example: Betterment and Wealthfront use AI-driven robo-advisors to help millions of clients manage investments efficiently with personalized strategies.

2. Predictive Risk Analysis

Overview: AI models forecast potential financial risks and detect anomalies in investment portfolios.

Industries Served: Investment banking, asset management, and corporate finance.

How It Works: Machine learning models scan market data, client portfolios, and historical records to predict possible downturns or portfolio risks.

Impact: Wealth managers proactively adjust portfolios, minimizing losses while improving risk-adjusted returns.

Real-World Example: BlackRock’s Aladdin platform integrates AI risk analysis to provide predictive insights for institutional and retail investors.

3. AI-Powered Chatbots for Client Engagement

Overview: Virtual assistants offer 24/7 support to clients for inquiries, transactions, and personalized investment updates.

Industries Served: Wealth management firms, private banks, and insurance companies.

How It Works: Chatbots trained on financial knowledge bases handle queries, provide portfolio updates, and suggest investment opportunities.

Impact: Firms improve customer service quality, cut operational costs, and engage clients in real time.

Real-World Example: JPMorgan Chase uses AI-driven chatbots to streamline client communication and provide faster portfolio support.

4. Fraud Detection and Compliance Monitoring

Overview: AI systems monitor transactions and detect fraudulent activities in real time.

Industries Served: Banking, financial advisory firms, and investment companies.

How It Works: AI models analyze transaction patterns, detect unusual activity, and flag potential risks for compliance teams.

Impact: Firms reduce fraud-related losses, maintain regulatory compliance, and build trust with clients.

Real-World Example: HSBC employs AI tools to enhance fraud detection and comply with global anti-money laundering (AML) regulations.

5. Personalized Investment Recommendations

Overview: AI tailors investment suggestions based on client behavior, financial goals, and market conditions.

Industries Served: Wealth management and retail investing.

How It Works: Algorithms track client preferences, financial milestones, and real-time market data to deliver unique strategies.

Impact: Enhances customer satisfaction and loyalty while driving higher returns aligned with client goals.

Real-World Example: Morgan Stanley’s “Next Best Action” platform uses AI to provide financial advisors with tailored client recommendations.

6. Portfolio Optimization with AI

Overview: AI ensures that portfolios are dynamically adjusted to maximize returns and minimize risks.

Industries Served: Asset management, hedge funds, and private wealth.

How It Works: Algorithms monitor assets, market trends, and global events to rebalance portfolios automatically.

Impact: Investors achieve better diversification and returns while wealth managers save time on manual monitoring.

Real-World Example: Charles Schwab’s Intelligent Portfolios uses AI to manage risk and optimize portfolios for clients automatically.

7. AI-Driven Market Sentiment Analysis

Overview: Natural Language Processing (NLP) tools analyze news, reports, and social media to gauge investor sentiment.

Industries Served: Hedge funds, investment banking, and stock trading.

How It Works: AI systems evaluate millions of text data points to identify market-moving signals.

Impact: Wealth managers anticipate market shifts earlier and make informed investment decisions.

Real-World Example: Bloomberg uses AI-driven sentiment analysis to strengthen financial decision-making and trading strategies.

8. Tax Optimization with AI

Overview: AI identifies tax-efficient investment opportunities to minimize liabilities and maximize after-tax returns.

Industries Served: Wealth management, corporate finance, and private banking.

How It Works: Algorithms track tax rules, exemptions, and portfolio strategies to recommend tax-smart investment moves.

Impact: Investors save significantly on taxes while ensuring compliance with regulations.

Real-World Example: Wealthfront integrates tax-loss harvesting features powered by AI for better tax optimization.

9. AI for Financial Planning and Forecasting

Overview: AI models help advisors project future income, expenses, and long-term wealth growth.

Industries Served: Financial advisory firms and retirement planning companies.

How It Works: AI analyzes client spending, savings, and investments to predict wealth outcomes over time.

Impact: Clients get accurate roadmaps for retirement planning, estate planning, and wealth transfer.

Real-World Example: Fidelity uses AI tools to provide long-term financial forecasts and goal tracking for clients.

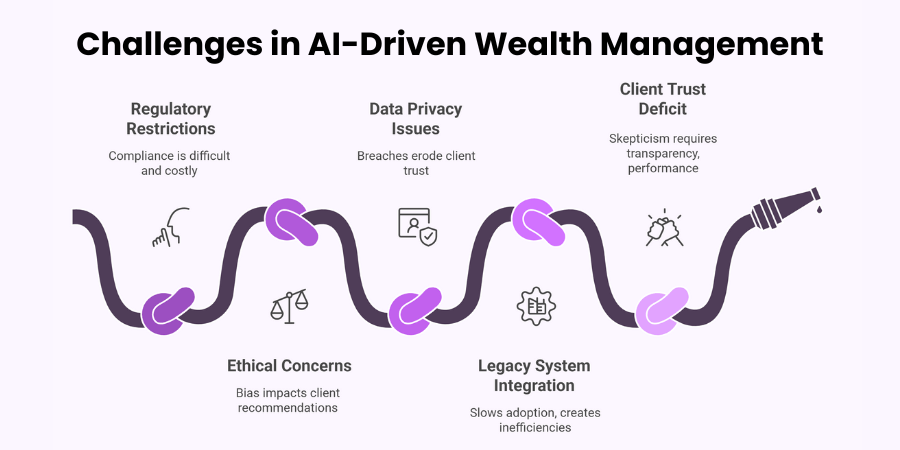

Challenges in AI-Driven Wealth Management

Despite its rapid adoption, AI in wealth management faces several barriers that firms must overcome to maximize benefits.

Regulatory Restrictions:

The financial industry is tightly regulated, and AI systems must comply with evolving local and global laws. Wealth managers face difficulties aligning AI-driven decisions with regulations like MiFID II, GDPR, and SEC standards. Non-compliance can lead to penalties and reputational damage.

Ethical Concerns:

AI systems may unintentionally introduce bias in investment decisions, impacting fairness in client recommendations. Ethical concerns also arise when firms rely too heavily on automated advice, reducing the human touch in wealth management.

Data Privacy Issues:

Wealth management involves sensitive client financial data. AI platforms require access to this information, raising concerns about breaches, misuse, or unauthorized sharing. Ensuring robust cybersecurity and encryption is critical for protecting client trust.

Integration with Legacy Systems:

Many wealth management firms still operate on outdated IT infrastructure. Integrating advanced AI platforms with these legacy systems is complex, costly, and time-intensive. This slows down adoption and creates operational inefficiencies.

Building Client Trust in AI Recommendations:

Clients often hesitate to fully trust AI-generated financial advice, preferring human expertise. Overcoming skepticism requires transparency in how AI makes decisions and demonstrating consistent performance over time.

Future of AI in Wealth Management

If you think AI has already transformed wealth management, the coming years will take it even further. Emerging trends point toward a future where AI delivers hyper-personalized portfolios, supports ESG-driven investments, enables real-time predictive decision-making, and powers the next generation of robo-advisors.

Imagine having a portfolio that not only reflects your financial goals but also adapts dynamically to market conditions and personal life events. That is the promise of hyper-personalization through AI. Similarly, ESG (Environmental, Social, and Governance) investments will gain more traction as AI helps investors identify sustainable opportunities that align with both profit and ethical goals.

Another game-changing development will be real-time predictive decision-making. Instead of waiting for quarterly updates or traditional advisor consultations, investors will receive instant insights powered by continuous AI-driven data analysis. And next-generation robo-advisors will no longer be limited to simple rebalancing tasks—they will act more like virtual wealth managers, offering holistic, round-the-clock guidance.

To give you a clearer picture of this shift, let us compare the traditional wealth management approach with the AI-powered modern approach:

| Aspect | Traditional Wealth Management (Without AI) | Modern Wealth Management (With AI) |

| Portfolio Personalization | Based on general risk categories and manual advisor input | Hyper-personalized portfolios tailored to individual goals, behaviors, and life events |

| ESG Investments | Limited analysis, often slow and manual | AI-driven ESG scoring and real-time identification of sustainable opportunities |

| Decision-Making Speed | Quarterly reviews and delayed responses to market changes | Real-time predictive decision-making with instant portfolio adjustments |

| Robo-Advisors | Basic rebalancing and automated savings tools | Next-gen robo-advisors acting as comprehensive digital wealth managers |

| Client Engagement | Periodic meetings with financial advisors | Continuous engagement via chatbots, dashboards, and AI-driven insights |

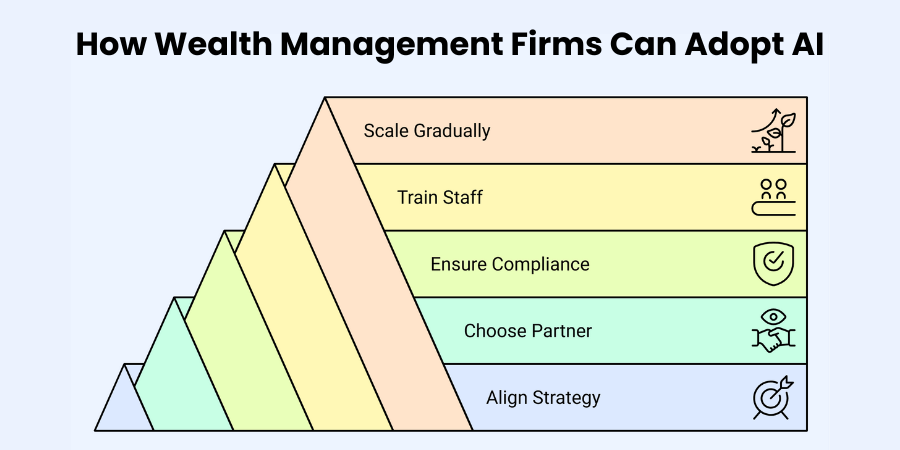

How Wealth Management Firms Can Adopt AI

If you are considering integrating AI into your wealth management firm, it is important to approach it strategically. Adopting AI is not just about buying software—it is about transforming workflows, improving client experiences, and enhancing investment outcomes. Here is a clear roadmap to help your firm get started:

- Align AI Initiatives with Business Strategy

Start by identifying the key areas where AI can add value. Are you aiming to improve portfolio management, enhance client communication, or reduce operational costs? Clear goals ensure that AI adoption aligns with your firm’s overall strategy and delivers measurable results. - Choose the Right Technology Partner

Selecting a trusted AI technology provider is critical. Look for partners with experience in financial services, strong security protocols, and scalable solutions. Your tech partner should be able to customize AI tools to match your specific business needs. - Ensure Compliance and Data Security

AI systems must comply with financial regulations and data privacy laws. Establish robust compliance frameworks, implement encryption protocols, and continuously monitor AI outputs to ensure regulatory standards are met. This step protects your firm and builds client confidence. - Train Your Staff

Technology is only effective when people know how to use it. Invest in staff training so advisors, analysts, and operations teams understand how AI works, how to interpret its insights, and how to integrate it into daily workflows. A hybrid model—combining human expertise with AI recommendations—often produces the best outcomes. - Start Small and Scale Gradually

Begin AI adoption with a pilot program in a specific area, such as portfolio analysis or client engagement. Measure results, learn from initial implementation, and then expand to other areas. Gradual scaling minimizes risks and allows your firm to adapt processes effectively.

Conclusion

Artificial intelligence is transforming wealth management in ways that were unimaginable just a few years ago. From hyper-personalized investment strategies to predictive risk analysis and real-time client engagement, AI is redefining how advisors serve clients and manage portfolios.

If your firm adopts AI strategically, you can gain a clear competitive edge. Not only will operational efficiency improve, but clients will also benefit from smarter, more tailored financial advice. In short, AI empowers wealth managers to deliver better outcomes, build stronger client trust, and achieve long-term portfolio success.

Whether you are an advisor, a firm executive, or an investor, understanding and leveraging AI in wealth management is no longer optional—it is essential for thriving in today’s rapidly evolving financial landscape.

FAQs

- What exactly does AI do in wealth management?

AI helps wealth managers analyze data, create personalized investment strategies, assess risks, automate tasks, and engage clients more effectively. - Can AI completely replace human advisors?

No, AI is a tool to assist advisors. The best results come from combining AI insights with human expertise and judgment. - How secure is client data when using AI platforms?

Reputable AI platforms use strong encryption, strict access controls, and compliance measures to ensure client data privacy and security. - Are AI-powered investment tools expensive for firms to implement?

Costs vary depending on the scale and complexity of adoption, but starting with pilot programs allows firms to invest gradually and measure ROI. - How can clients benefit directly from AI in wealth management?

Clients receive faster insights, more personalized advice, better risk management, and continuous engagement through dashboards, chatbots, and AI-driven recommendations.

Shaif Azad

Related Post

Enterprise Generative AI: Applications, Challenges, and Best Practices

Are you wondering how your organization can stay competitive in today’s rapidly evolving business landscape? The...

How Conversational AI Delivers Measurable ROI for Businesses

Are you considering conversational AI for your business but questioning whether the investment will deliver real...

How Chatbots Help Businesses Reduce Costs and Scale Faster

Are you lying awake wondering how your business can cut operational costs without sacrificing quality? Have...